After the Management Proposal is published, the shareholders make nominations for the Board of Directors, which are subsequently submitted to the Chief of Staff of the Government of the State of Rio Grande do Sul for approval. If the nominations are approved, their names and information will be forwarded to the Treasury Department for the opening of an administrative proceeding via the PROA system. Upon the receipt of the Administrative Proceeding, the Eligibility and Compensation Committee analyzes the nominee, taking into consideration the eligibility requirements outlined in the Nomination and Succession Policy, which determine that the background and experience of the nominees for the Board of the Directors should be assessed, as well as their time availability to perform the duties, diversity, knowledge, experience, behavior, cultural aspects, age group, and gender. The Committee’s opinion is forwarded to the State Attorney General’s Office for a final decision about the fulfillment of the requirements and the absence of impediments. Once the nomination has been approved by the State Attorney General’s Office, the proceeding returns to the Company, so that the election can be held.

Every two years, before the Annual and Extraordinary Shareholders’ Meeting, shareholders submit their candidates for the highest governance body. The controlling shareholder makes its nominations considering the criteria set forth in the current legislation (Federal Law 13,303/16; Federal Law 6,404/46 and State Decree RS 54,110/18).

In 2022, the Nomination and Succession Policy was updated and stated that the election of Banrisul’s Board of Directors members, should include seats for Diversity groups as of 2023, as follows: I – the shareholder, or group of shareholders, with a right to nominate 25-40% of seats on Banrisul’s Board of Directors, shall be responsible for allocating at least one of the openings for members of the Diversity group; II – the shareholder, or group of shareholders, with a right to nominate for Banrisul’s Board of Directors any percentage higher than that established in item I must allocate two or more openings for members of the Diversity group; III – Grupo Banrisul must adjust the composition of the Boards of Directors, which shall respect the minimum percentage of 30% for openings aimed at the Diversity group, by 2030.

Independence criteria must also be considered, as provided for in article 22 of the Bylaws, which can be read here.

Banrisul’s current eligibility process involves several spheres (State Department of Finance, State Chief of Staff and State Attorney General’s Office, among others). This verification flow conveys security and reliability to all stakeholders.

The Institution is grounded on its values defined in its Code of Ethics as transparency, ethics, commitment, integration and efficiency, as well as in principles and guidelines, such as integrity, respect for diversity, people, appreciation of work, social and environmental responsibility, respect for competition, respect for the image and excellence in rendering services.

The commitments refer to internationally recognized intra-governmental instruments, namely the Brazilian Central Bank, Febraban, National Monetary Council, UN Global Compact Guidelines and SDG 16.

These guidelines/policies set forth responsibilities and consequences for all levels.

Banrisul manages capital and credit, market, interest rate variation risks for the instruments classified in the banking portfolio – IRRBB- in a continuous and integrated manner; as well as liquidity, operational, social, environmental, climate and other risks considered relevant.

Social risk, defined as the possibility of the Institution incurring in losses from events related to the violation of fundamental rights and guarantees or by acts that are harmful to the common interest, is one of the relevant risks included in the Risk Management Policies.

Banrisul does not have a specific human rights policy.

Human rights are rules that recognize and protect the dignity of all human beings and govern how individual human beings live in society and among themselves, as well as their relationship with the State and the obligations that the State has in relation to them. In this regard, as a signatory to the Global Compact since 2013, Banrisul reaffirms its commitment to the well-being of its employees, as well as to seeking to ensure the rights of its customers, suppliers and all stakeholders to which it engages. The Bank manages social risk, particularly, in order to mitigate possible actions that may occur under the human rights aspect.

The stakeholder categories to whom the Organization pays special attention in this commitment are employees, customers, suppliers and vulnerable publics.

Policy commitments should be approved by the Board of Directors. These commitments apply to management members, board members, employees, interns, members of the Banrisul Group, business partners, suppliers and the Group’s service providers.

An Administrative Instruction is issued stating that all employees must sign a Compliance Agreement, which is published in the Institutional Manual (Chapter 04 of Banrisul’s Code of Ethics and Conduct).

All employees receive training on the Code of Ethics and Conduct and the Anti-Corruption Policy. Banrisul has other institutional policies and makes a whistleblowing channel available both on the internal and external websites. The commitments of the Code of Ethics and the Anti-Corruption Policy are available to the public.

The responsibilities of the Eligibility and Compensation Committee are:

(i) drafting the compensation policy for Management of the Bank and its subsidiaries, suggesting to the respective Boards of Directors various forms of fixed and variable compensation, in addition to benefits and special recruiting and severance programs;

(ii) proposing to the Boards of Directors of the Bank and subsidiaries the overall Management compensation amount to be submitted to the respective Shareholders’ Meetings, pursuant to Article 152, of Law 6,404, of 1976;

(iii) assessing future internal and external scenarios and their possible impacts on the Management compensation policy of the Bank and its subsidiaries;

(iv) analyzing the Management compensation policy of the Bank and its subsidiaries vis-à-vis market practices in order to identify significant discrepancies compared its peers, proposing the necessary adjustments.

As per CMN Resolution 3,921/10, the Eligibility and Compensation Committee is responsible for assisting in the process of determining compensation. The Committee is composed of three independent members, all of whom are natural persons residing in Brazil, with higher education degrees and technical skills suitable for the position they hold. The members also meet the criteria for holding positions in statutory bodies of financial and other institutions authorized to operate by the Brazilian Central Bank.

The board members convene in ordinary and extraordinary meetings, and their considerations are recorded in minutes. In turn, shareholders can express their opinions at the Annual/Extraordinary Shareholders Meeting.

The Board of Directors members are only entitled to fixed monthly compensation as fees, and are not entitled to variable compensation or direct and/or indirect benefits. Executive Board members are entitled to monthly compensation in the form of monthly wage plus a representation fee, the annual amount of which must not exceed the overall management compensation amount set by the Extraordinary and Annual Shareholders’ Meeting. They are also entitled to Banrisul’s Profit Sharing Program (PLR, in Portuguese), calculated in accordance with the rules established by the Board of Directors, considering the rules applicable to the payment of PLR to employees, as defined in the Banking Employees’ Collective Bargaining Agreement. In addition to the PLR, the Banrisul Conglomerate may pay variable compensation to its executive officers, provided it is included in the overall compensation approved by the Shareholders’ Meeting, observing the limits established by the legislation in force and based on criteria that may be defined by the Board of Directors.

The report is published every year and this reporting period is between January 1, 2022 and December 31, 2022.

Contact: Sustainability Corporate Department, Rua Caldas Júnior, 108, 6º andar

E-mail: Sustentabilidade@banrisul.com.br

No information has been restated in previous reporting periods.

The composition of the Board of Directors ensures a seat for common minority shareholders, preferred minority shareholders and a representative of the employees, who is chosen by internal election, according to the Board of Directors Charter. Thus, stakeholder groups are engaged in the Board of Directors meetings.

The Board of Directors is responsible for the Company’s overall direction of business, institutional guidelines and goals. As regards Integrated Capital and Corporate Risk Management, the Board is responsible for:

a) Establishing the Institution’s risk appetite levels in the Risk Appetite Statement (RAS) and reviewing them supported by the Risk Committee, the Executive Board and the Chief Risk Officer (CRO);

b) Ensuring compliance with the Institution’s policies, strategies and risk management limits;

c) Whenever necessary, authorizing exceptions to policies, procedures, limits and risk appetite levels set out in the RAS;

d) Ensuring that the Institution’s compensation structure does not encourage behaviors that are incompatible with risk appetite levels set out in the RAS;

e) Ensuring that the Institution keeps adequate and sufficient capital and liquidity levels;

f) Having a broad and integrated knowledge of risks that can hinder capital.

As for Corporate Risk Management, the Board of Directors, the Risk Committee, the CRO and the Executive Board have seral joint responsibilities, including:

a) Understanding, in a broad and integrated way, risks that can impact the Institution’s capital and liquidity;

b) Understanding the limits of information included in capital and risk management reports;

c) Ensuring that the Institution complies with the content of the RAS;

d) Understanding the limits and uncertainties related to the assessment of risk models, even when they are developed by a third party, and the methodologies used in risk management structure; and

e) Ensuring the Institution’s different levels understand and continually monitor risks.

The Board of Directors meets periodically to evaluate changes to the capital and corporate risk management policies, as well as management reports on the main risks to which the Institution is exposed. At Management level, Banrisul relies on the Corporate Risk Committee and the Control and Risk Executive Office and, statutorily, on the Statutory Risk Committee.

In compliance with CMN Resolution 4,945, of September 15, 2021, Banrisul’s Social, Environmental and Climate Responsibility Policy (PRSAC, in Portuguese) determines that it is incumbent upon the Executive Board, a governance body elected by the Board of Directors, to:

a) provide input and participate in the decision-making related to the drafting and review of the PRSAC, assisting the Board of Directors;

b) support the implementation of actions to ensure this Policy’s effectiveness;

c) monitor and evaluate implemented actions;

d) ensure that implemented actions are improved whenever possible deficiencies are identified;

e) help and encourage the adequate and reliable dissemination of mandatory information;

f) manage the PRSAC at Banrisul. The responsibilities of the Board of Directors include ensuring that the Institution complies with the PRSAC and taking measures to ensure its effectiveness.

Banrisul has a the Social, Environmental and Climate Responsibility Committee (CRSAC, in Portuguese), an advisory body to the Board of Directors, whose duties and responsibilities are to:

a) make recommendations to the Board of Directors on the drafting and review of the Social, Environmental and Climate Responsibility Policy;

b) evaluate if the actions implemented are in compliance with the Social, Environmental and Climate Responsibility Policy and, whenever necessary, make recommendations for improvement;

c) keep records of its deliberations and decisions;

d) evaluate and monitor the Bank’s sustainable performance and the effectiveness of the actions laid down in the Sustainability Plan;

e) monitor advancements in sustainability, seeking to identify opportunities and risks, in order to create value for the Bank and its stakeholders;

f) propose and follow-up the execution of initiatives that improve the Bank’s socio-environmental performance;

g) assisting the Board of Directors in incorporating sustainability into the Company’s business strategy and administrative practices and follow up its progress;

h) analyze, monitor and issue recommendations and opinions to support the Board of Directors’ decisions on policies and practices related to its field;

i) fulfil other duties determined by the Board of Directors.

The Message from the CEO can be found in the Sustainability Report on page 4.

The number of workers who are not employees and whose work is controlled by the organization amounts to 2,204, of whom four are supernumeraries and 2,200¹ are interns.

Most common workers are interns, whose contractual relationship is established through an integration agent called Center for Company and School Integration (CIEE, in Portuguese). Interns serve bank customers, act as cashiers, provide documents to customers and perform collection activities. They also provide supporting services to the branches and other Bank departments, manage the flow of bank bags, clear documents and control documents in the archives.

The methodology and assumptions used to obtain this indicator gather data from the internal database. The significant change in the number of workers is due to the duration of the internship contract, which is up to two years.

¹ The 2022 Administration Report shows 2,293 trainees. The difference is due to the criteria used in the consultation, which also included those who left during the month. After adjustments, those who left during the month were disregarded for the purposes of the Sustainability Report.

The ratio of the annual total compensation for the organization’s highest-paid individual to the median annual total compensation for all employees is 12.0%, while the ratio of the percentage increase in the annual total compensation for the organization’s highest-paid individual to the median percentage increase in the annual total compensation for all employees is 0.8%.

Annual salary increases occur in April (regulatory promotions retroactive to January) and in September (collective bargaining agreement).

For calculation purposes, the CEO, who is not a Bank employee, was considered as the highest-paid individual. The other workers who are not employees were not considered in the calculation. The total compensation (salaries, bonuses, job commission, full performance bonus, annual bonus, overtime, singing bonus, relocation bonus, management, retirement bonus, and retirement incentive) was considered in calculating compensation.

Banrisul operates in the public and private sectors. The Bank and its affiliates currently have several types of suppliers: lawyers; consultants; system analysts; sellers of perishable and non-perishable goods; international IT companies; armored truck companies; and numerous other service providers.

The number of direct suppliers, in 2022, is estimated at 1,093. The Bank hires suppliers to provide services and products unrelated to its core activity, i.e., they provide supporting services and products, including security, cleaning, transportation of valuables, acquisition of IT systems, telephone and internet services, acquisition of furniture, building rental, acquisition of sundry items.

Banrisul acts as a financial agent for customers, from industry, agriculture, transport, service, trade and health sectors. Most of them are located in Brazil’s South region.

Stakeholder categories with whom Banrisul engages are:

The Institution has identified the need to create a stakeholder engagement program to strengthen its relationship with these groups and provide greater business opportunities and chances to listen to them. The goal is that this program enables the Institution to explore relationship channels with several groups.

For preparing its materiality, Banrisul surveyed all its target audiences, creating an opportunity to get to know their interests.

The Chair of the Board of Directors is not the Company’s CEO.

100% of employees are covered by collective bargaining agreements.

In compliance with Law 13,303/16, every year, elected Management members attend specific training on corporate and capital market legislation, disclosure of information, internal controls, code of conduct, Law 12,846, of August 1, 2013 (Anti-Corruption Law) and other topics related to the activities of a publicly held company or government-controlled company. In 2022, ESG was included in the list of topics. Additionally, Management members may participate in other courses/events with themes pertinent to their responsibilities in the respective governance bodies, if said theme is interesting for the Company.

Suspicions or evidence of non-compliance with Banrisul’s Code of Ethics and Conduct, policies, standards and institutional regulations in force should be reported through the Whistleblowing Channel, which allows the anonymous reporting of the misconduct, ensuring the right to confidentiality and protection against retaliation. The internal and external channels are available, respectively, on the Corporate Intranet and on Banrisul’s website (www.banrisul.com.br) and are intended for receiving misconduct reposts and complaints from employees and other stakeholders. The Control and Compliance Department is the independent area responsible for managing this channel.

Every six months the Board of Directors reviews a report on Banrisul’s Whistleblowing Channel. In compliance with article 3, paragraph 2, of CMN Resolution 4,859/2020, the Control and Compliance Department prepares a report with the following minimum information:

I – the number of reports received;

II – the nature of the reports;

III – the departments responsible for handling the situation;

IV – the average response time; and

V – the measures adopted by the Institution.

In 2022, there were 1,085 significant instances of non-compliance with laws and regulations, of which only one incurred in fine (one instance of irregular waste disposal). 720 Municipal Tax Unit (UFM, in Portuguese) (R$3,554.06) repaid by the outsourced cleaning company (as set forth in the contract) and other non-monetary penalties. Out of the 1,084 administrative or judicial proceedings that did not incur in fines, 1,082 are social in scope: six are events related to accessibility, 20 to over-indebtedness, one to customer moral harassment, 1,055 are labor complaint events (according to CMN Resolution 4,943/21), one environmental event (disposal of recyclable waste in an organic waste container), one climate-related event (collection lawsuit to recover the amounts from the plaintiff’s property insurance policy, affected by a storm).

Additionally, Banrisul received 262 notifications in this reporting cycle, 45 of which were fines for instances of non-compliance with laws, and all of these were paid during previous reporting periods.

Banrisul’s Board of Directors identifies and manages conflicts of interest based on, but not limited to, applicable legal standards provided for in Article 156 of the Brazilian Corporate Law and article 25 of its Bylaws. Furthermore, the Code of Ethics and Conduct is widely disseminated to management members, board members, employees, interns, members of the Banrisul Group, business partners, suppliers and service providers. In the event of a potential conflict of interest, members of the Board of Directors, the Audit Committee and the Ethics Committee must abstain from resolving on matters in which this conflict is identified. Another important document governing this topic is the Related-Party Transactions Policy that outlines the conditions credit transactions and other related-party transactions.

The item “SUBORDINATION, SERVICE OR CONTROL RELATIONSHIPS BETWEEN THE ISSUER’S MANAGEMENT AND ITS SUBSIDIARIES, AFFLIATES AND OTHERS” of the Company’s Reference Form informs the interest held by Banrisul management in management of other companies in the Banrisul Group. The only controlling shareholder is the State of Rio Grande do Sul.

Related-party transactions, as well as measures taken by Banrisul, can be found in Note 29, pages 118 and 119, to the 2022 Financial Statements, available here.

The Control and Risk Executive Office is responsible for managing the Institutions’ corporate risks.

As regards Integrated Capital and Corporate Risk Management, the Chief Risk Officer (CRO) is responsible for the Corporate Risk Management Department and his/her duties include ensuring that the risk process monitors, controls, evaluates and plans capital need and goals and identifies, measures, monitors, reports, controls and mitigates credit, market, IRRBB, liquidity, operational, social, environmental and climate risks associated with the Prudential Conglomerate, communicating said risks to the Risk Committee, the CEO, the Board of Directors and regulatory agencies.

The Corporate Risk Executive Superintendent reports to the CRO on the Institution’s risk management. At least every year, risk management reports are submitted to the Board of Directors for consideration.

The credit policies definitions are available in internal regulations and are also parameterized in the “Customer Registration”, “Negative Incidents” and “Risk Calculation” systems. The Bank currently checks with external agencies whether the customer, either an individual or a company, has been listed as an “Employer that uses Forced Labor” or as causing “Environmental Damage” (conviction for environmental damage in actions filed by Brazil’s environmental protection agency (IBAMA, in Portuguese)).

Customers identified as “Employer of Forced Labor” are prevented from contracting any type of credit operations. We also monitor customers who already have a relationship with us and who may be included in those lists, taking specific actions to discontinue the business relationship.

All employees receive training on the Code of Conduct and Ethics and on Anti-Corruption. Banrisul has other institutional policies and makes a whistleblowing channel available both on the internal and external websites.

Banrisul’s Whistleblowing Channel is a communication tool that allows employees, customers, users, partners or suppliers to report possible misconduct of any nature related to the Institution’s activities that affect its reputation and violate its internal controls and Banrisul’s Compliance Program.

The Whistleblowing Channel recorded stable figures in 2018 and 2019, receiving 155 and 153 reports, respectively. In the following years, the number of reports spiked significantly to 536 in 2020 and 433 in 2021. This increase had two main reasons: first, the Institution made a channel available to external stakeholders, offering more visibility, thus increasing the number of reports; and second, the pandemic, which altered the service routine at the branches, leading Customers to use this channel to request information from the Bank.

In 2022, there was a significant reduction, only 234 contacts were made, reflecting the acculturation of the correct use of the channel.

Banrisul’ participates in Febraban’s committees and squads, in AMCHAM’s ESG Committee and the Interinstitutional Committee on Environmental Education (CIEA in Portuguese).

Banrisul is concerned about the credibility of its information disclosed to the market and submits its sustainability report to independent external limited assurance by Deloitte, which also audits the financial statements.

The assurance letter can be found in the Sustainability Report on page 119.

Performance evaluation is an essential step to assess effectiveness, contributing to enhance the Organization’s governance. The Board of Directors carries out an annual formal evaluation of the Executive Board and its Chair performance, as well as of its own performance, a process that include self-evaluation questions. The annual evaluation is carried out according to procedures previously defined by the Board of Directors and is anonymous and individual.

All answers to the evaluation questionnaires are compiled into a report, which is sent to the Eligibility and Compensation Committee for prior analysis and then presented to the Board of Directors for consideration. The body itself suggests improvements in carrying out their duties.

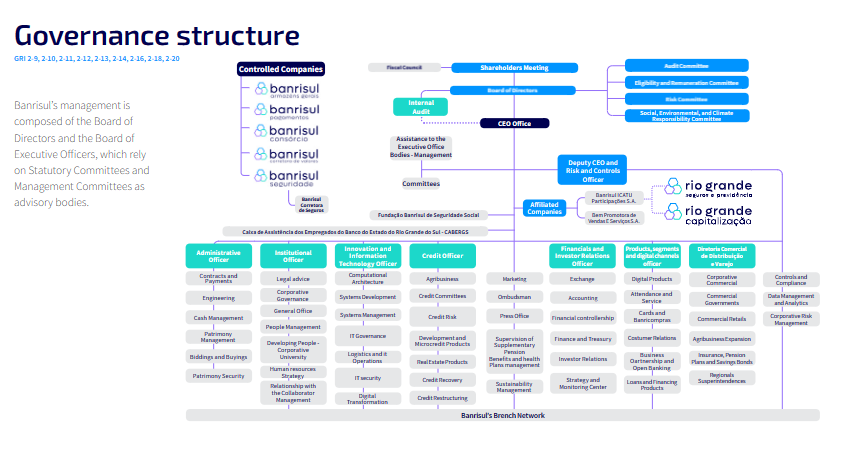

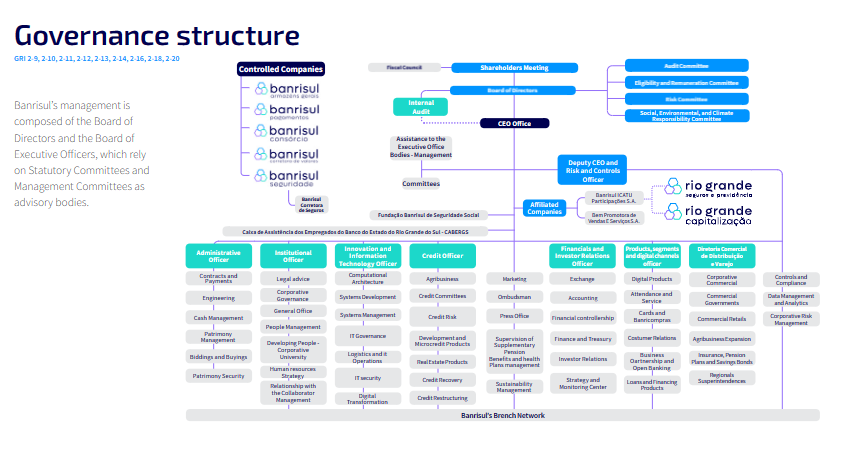

Banco do Estado do Rio Grande do Sul (Banrisul) is a government-controlled corporation. Banrisul’s General Management, its administrative headquarters, is located in the city of Porto Alegre, Rio Grande do Sul state.

| 2020 | 2021 | 2022 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Men | Women | Total | Men | Women | Total | Men | Women | Total | |

| Permanent and full-time employees | 5,129 | 4,151 | 9,280 | 4,946 | 4,056 | 9,002 | 4,729 | 3,929 | 8,658 |

¹Banrisul does not have temporary, non-guaranteed hours and part-time employees.

²All permanent employees are full-time employees.

| Region¹ | 2020 | 2021 | 2022 |

|---|---|---|---|

| Midwest | 9 | 7 | 8 |

| South | 9,214 | 8,939 | 8,600 |

| Southeast | 57 | 56 | 50 |

| Total | 9,280 | 9,002 | 8,658 |

¹Banrisul does not have employees in the North and Northeast regions.

Data were gathered from a proprietary system, considering total employees for the reference period.

The consolidated financial statements include the operations of Banrisul, its offices abroad, its subsidiaries (Banrisul Armazéns Gerais S.A., Banrisul S.A. Corretora de Valores Mobiliários e Câmbio, Banrisul S.A. Administradora de Consórcios, Banrisul Soluções em Pagamentos S.A., Banrisul Seguridade Participações S.A.) and investment fund quotas in which Banrisul substantially takes or incurs in risks and benefits. We explain the Banrisul Group in detail, which comprises six subsidiaries and four affiliated companies.

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Jorge Luís Tonetto | Chairman - non-executive position | No | 2021 - 2023 |

| Claudio Coutinho Mendes | Vice chairman - executive position | No | 2021 - 2023 |

| Irany de Oliveira Sant’Anna Junior | Member - executive position | No | 2021 - 2023 |

| Márcio Gomes Pinto Garcia | Member - non-executive position | No | 2021 - 2023 |

| Eduardo Cunha da Costa | Director - non-executive position | No | 2021 - 2023 |

| Ramiro Silveira Severo | Member - non-executive position | Yes | 2021 - 2023 |

| João Verner Juenemann | Member - non-executive position | Yes | 2021 - 2023 |

| Rafael Andréas Weber | Member elected by minority common shareholders - non-executive position | Yes | 2021 - 2023 |

| Adriano Cives Seabra | Member elected by minority preferred shareholders non-executive position | Yes | 2021 - 2023 |

| Márcio Kaiser | Member - appointed by the employees - non-executive position | No | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Bruno Pinto de Freitas | Sitting member, elected by majority shareholders- non-executive position | No | 2021 - 2023 |

| Rogério Costa Rokembach | Sitting member, elected by majority shareholders- non-executive position | Yes | 2021 - 2023 |

| Gustav Penna Gorski | Sitting member, elected by minority common shareholders - non-executive position | Yes | 2021 - 2023 |

| Reginaldo Ferreira Alexandre | Sitting member, elected by preferred shareholders - non-executive position | Yes | 2021 - 2023 |

| Bruno Queiroz Jatene | Alternate, elected by majority shareholders - non-executive position | No | 2021 - 2023 |

| Tanha Maria Lauermann Schneider | Alternate, elected by majority shareholders - non-executive position | Yes | 2021 - 2023 |

| Vicente Jorge Soares Rodrigues | Alternate, elected by majority shareholders - non-executive position | Yes | 2021 - 2023 |

| Paulo Roberto Franceschi | Alternate, elected by preferred shareholders - non-executive position | Yes | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| João Verner Juenemann | Coordinator - non-executive position | Yes | 2020 - 2022 |

| Carlos Biedermann | Member - non-executive position | Yes | 2021 - 2023 |

| Eraldo Soares Peçanha | Member - non-executive position | Yes | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Arnaldo Bonoldi Dutra | Member - non-executive position | Yes | 2021 - 2024 |

| José Luiz Castro Mendel | Member - non-executive position | Yes | 2021 - 2024 |

| Giusepe Lo Russo | Member - non-executive position | No | 2021 - 2024 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| João Zani | Coordinator - non-executive position | Yes | 2022 - 2024 |

| José Luis Campani Lourenzi | Member - non-executive position | No | 2022 - 2024 |

| Carlos Eduardo Schonerwald da Silva | Member - non-executive position | Yes | 2022 - 2024 |

| Luanda Pereira Antunes | Member - non-executive position | Yes | 2021 - 2023 |

| Márcio Gomes Pinto Garcia | Member - non-executive position | Yes | 2021 - 2023 |

| Member | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Claíse Muller Rauber | Coordinator - Non-executive position | No | 2022 - 2023 |

| Wagner Lenhart | Member - non-executive position | No | 2022 - 2023 |

| Marivania Ghisleni Fontana | Member - non-executive position | No | 2022 - 2023 |

| Jorge Luís Tonetto | Member - non-executive position | No | 2022 - 2023 |

| Marilene de Oliveira Ramos Murias dos Santos | Member - non-executive position | Yes | 2023-2023¹ |

¹ Sworn in February 2023.

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Claudio Coutinho Mendes | CEO - executive position | No | 2021 - 2023 |

| Irany de Oliveira Sant’Anna Junior | Deputy CEO and Risk and Controls Officer - executive position | No | 2021 - 2023 |

| Claíse Muller Rauber | Products, Segments and Digital Channels Officer - executive position | No | 2021 - 2023 |

| Fernando Postal | Distribution and Retail Officer - executive position | No | 2021 - 2023 |

| Jorge Fernando Krug Santos | IT and Innovation Officer - executive position | No | 2021 - 2023 |

| Marcus Vinícius Feijó Staffen | CFO and IRO - executive position | No | 2021 - 2023 |

| Osvaldo Lobo Pires | Credit Officer - executive position | No | 2021 - 2023 |

| Wagner Lenhart | Institutional Officer - executive position | No | 2021 - 2023 |

| Marivania Ghisleni Fontana | Administrative Officer - executive position | No | 2021 - 2023 |

In 2022, Banrisul conducted a complete materiality assessment to define its material topics, which encompassed peer benchmarking, as well as analysis of the Company’s internal documents and industry literature, such as ESG ratings and standards. A list of material topics for the industry was prepared based thereon. This list was discussed and validated with important stakeholders through interviews (the CEO, Sustainability Corporate Department and Executive Board) and, then it was prioritized through an online survey with a larger stakeholder group.

At the same time, based on the analysis of internal risk documents, the Company assessed possible impacts related to each topic, which were duly classified as regards their nature and then added to the consolidated materiality results.

Results were assessed using a methodology that weighted the answers according to each stakeholder group. The results of the online survey were consolidated to the topics’ impact study to prepare the final list of material topics.

A total of 1,315 people from the following stakeholder groups participated in the online survey:

Prioritization and final approval:

Sustainability Corporate Department, CEO and Administrative Executive Board. The materiality results were also presented to the Sustainability Committee, the Social, Environmental and Climate Responsibility Committee and the Executive Board.

List of material topics:

Compared to 2021, the following new topics were added to the materiality list: “Diversity and inclusion”, “Corporate governance and integrity”; “Data privacy and security”; “Partner and supplier management”, “Human capital development”, “Eco-efficiency” and “Financial inclusion and education”.

In 2022, the topics “Risk approach and opportunities related to climate change” and “Quality of customer service and services provided” were added to the “Environmental, social and climate risk strategy” and “Sales practices and customer satisfaction”, respectively. The topic “Management of risks that can significantly impact business” was also added to “Environmental, social and climate risk strategy”.

Furthermore, topics “Management of energy consumption and solid waste generation”, “Criteria for financing assignment, positive impact and delinquency”, “Social investment in the external community” and “Business expansion strategy” have been excluded in this new step.

After the Management Proposal is published, the shareholders make nominations for the Board of Directors, which are subsequently submitted to the Chief of Staff of the Government of the State of Rio Grande do Sul for approval. If the nominations are approved, their names and information will be forwarded to the Treasury Department for the opening of an administrative proceeding via the PROA system. Upon the receipt of the Administrative Proceeding, the Eligibility and Compensation Committee analyzes the nominee, taking into consideration the eligibility requirements outlined in the Nomination and Succession Policy, which determine that the background and experience of the nominees for the Board of the Directors should be assessed, as well as their time availability to perform the duties, diversity, knowledge, experience, behavior, cultural aspects, age group, and gender. The Committee’s opinion is forwarded to the State Attorney General’s Office for a final decision about the fulfillment of the requirements and the absence of impediments. Once the nomination has been approved by the State Attorney General’s Office, the proceeding returns to the Company, so that the election can be held.

Every two years, before the Annual and Extraordinary Shareholders’ Meeting, shareholders submit their candidates for the highest governance body. The controlling shareholder makes its nominations considering the criteria set forth in the current legislation (Federal Law 13,303/16; Federal Law 6,404/46 and State Decree RS 54,110/18).

In 2022, the Nomination and Succession Policy was updated and stated that the election of Banrisul’s Board of Directors members, should include seats for Diversity groups as of 2023, as follows: I – the shareholder, or group of shareholders, with a right to nominate 25-40% of seats on Banrisul’s Board of Directors, shall be responsible for allocating at least one of the openings for members of the Diversity group; II – the shareholder, or group of shareholders, with a right to nominate for Banrisul’s Board of Directors any percentage higher than that established in item I must allocate two or more openings for members of the Diversity group; III – Grupo Banrisul must adjust the composition of the Boards of Directors, which shall respect the minimum percentage of 30% for openings aimed at the Diversity group, by 2030.

Independence criteria must also be considered, as provided for in article 22 of the Bylaws, which can be read here.

Banrisul’s current eligibility process involves several spheres (State Department of Finance, State Chief of Staff and State Attorney General’s Office, among others). This verification flow conveys security and reliability to all stakeholders.

According to Banrisul’s Anti-Corruption Policy, all those subject to the Policy are responsible for fostering an ethical culture and for creating an environment of permanent corruption control and prevention, in which it is possible to monitor and identify, through Due Diligence procedures, operations from customers and non-customers – individuals and companies – and actions or suspected corruption crimes, as well as enforcing the internal integrity and auditing mechanisms and procedures, encouraging whistleblowing and the effective application of Banrisul’s Anti-Corruption Policy and Code of Ethics and Conduct.

Moreover, in 2021, a Social, Environmental and Climate Risks (RSAC, in Portuguese) assessment questionnaire was developed for operations over R$10 million, which includes anti-corruption questions.

Operational risk management includes identifying and assessing external fraud events, the possibility of employee misconduct that offers or results in undue advantage and operational flaws in developing processes to assess or identify suspicious operations.

The Bank is subject to Brazilian and foreign anti-corruption legislation. These laws require the adoption of integrity procedures in order to mitigate the risk that any person, acting on behalf of the Bank, may offer an undue advantage to a public agent, in order to obtain benefits of any kind. The transnational scope legislations, including, but not limited to, the U.S. Foreign Corrupt Practices Act of 1977 and the UK Bribery Act of 2000, in addition to Federal Law no. 12,846/13, provide for the adoption of specific policies and procedures for the prevention and fight against illegal acts related to corruption of public administration entities and government representatives, which aim at ensuring any kind of advantage. They also require the Bank to keep its books and records accurate and rely on an internal controls system to certify their respective veracity, in addition to the prevention of illegal activities.

The responsibilities of the Eligibility and Compensation Committee are:

(i) drafting the compensation policy for Management of the Bank and its subsidiaries, suggesting to the respective Boards of Directors various forms of fixed and variable compensation, in addition to benefits and special recruiting and severance programs;

(ii) proposing to the Boards of Directors of the Bank and subsidiaries the overall Management compensation amount to be submitted to the respective Shareholders’ Meetings, pursuant to Article 152, of Law 6,404, of 1976;

(iii) assessing future internal and external scenarios and their possible impacts on the Management compensation policy of the Bank and its subsidiaries;

(iv) analyzing the Management compensation policy of the Bank and its subsidiaries vis-à-vis market practices in order to identify significant discrepancies compared its peers, proposing the necessary adjustments.

As per CMN Resolution 3,921/10, the Eligibility and Compensation Committee is responsible for assisting in the process of determining compensation. The Committee is composed of three independent members, all of whom are natural persons residing in Brazil, with higher education degrees and technical skills suitable for the position they hold. The members also meet the criteria for holding positions in statutory bodies of financial and other institutions authorized to operate by the Brazilian Central Bank.

The board members convene in ordinary and extraordinary meetings, and their considerations are recorded in minutes. In turn, shareholders can express their opinions at the Annual/Extraordinary Shareholders Meeting.

The Board of Directors members are only entitled to fixed monthly compensation as fees, and are not entitled to variable compensation or direct and/or indirect benefits. Executive Board members are entitled to monthly compensation in the form of monthly wage plus a representation fee, the annual amount of which must not exceed the overall management compensation amount set by the Extraordinary and Annual Shareholders’ Meeting. They are also entitled to Banrisul’s Profit Sharing Program (PLR, in Portuguese), calculated in accordance with the rules established by the Board of Directors, considering the rules applicable to the payment of PLR to employees, as defined in the Banking Employees’ Collective Bargaining Agreement. In addition to the PLR, the Banrisul Conglomerate may pay variable compensation to its executive officers, provided it is included in the overall compensation approved by the Shareholders’ Meeting, observing the limits established by the legislation in force and based on criteria that may be defined by the Board of Directors.

The composition of the Board of Directors ensures a seat for common minority shareholders, preferred minority shareholders and a representative of the employees, who is chosen by internal election, according to the Board of Directors Charter. Thus, stakeholder groups are engaged in the Board of Directors meetings.

The Board of Directors is responsible for the Company’s overall direction of business, institutional guidelines and goals. As regards Integrated Capital and Corporate Risk Management, the Board is responsible for:

a) Establishing the Institution’s risk appetite levels in the Risk Appetite Statement (RAS) and reviewing them supported by the Risk Committee, the Executive Board and the Chief Risk Officer (CRO);

b) Ensuring compliance with the Institution’s policies, strategies and risk management limits;

c) Whenever necessary, authorizing exceptions to policies, procedures, limits and risk appetite levels set out in the RAS;

d) Ensuring that the Institution’s compensation structure does not encourage behaviors that are incompatible with risk appetite levels set out in the RAS;

e) Ensuring that the Institution keeps adequate and sufficient capital and liquidity levels;

f) Having a broad and integrated knowledge of risks that can hinder capital.

As for Corporate Risk Management, the Board of Directors, the Risk Committee, the CRO and the Executive Board have seral joint responsibilities, including:

a) Understanding, in a broad and integrated way, risks that can impact the Institution’s capital and liquidity;

b) Understanding the limits of information included in capital and risk management reports;

c) Ensuring that the Institution complies with the content of the RAS;

d) Understanding the limits and uncertainties related to the assessment of risk models, even when they are developed by a third party, and the methodologies used in risk management structure; and

e) Ensuring the Institution’s different levels understand and continually monitor risks.

The Board of Directors meets periodically to evaluate changes to the capital and corporate risk management policies, as well as management reports on the main risks to which the Institution is exposed. At Management level, Banrisul relies on the Corporate Risk Committee and the Control and Risk Executive Office and, statutorily, on the Statutory Risk Committee.

In compliance with CMN Resolution 4,945, of September 15, 2021, Banrisul’s Social, Environmental and Climate Responsibility Policy (PRSAC, in Portuguese) determines that it is incumbent upon the Executive Board, a governance body elected by the Board of Directors, to:

a) provide input and participate in the decision-making related to the drafting and review of the PRSAC, assisting the Board of Directors;

b) support the implementation of actions to ensure this Policy’s effectiveness;

c) monitor and evaluate implemented actions;

d) ensure that implemented actions are improved whenever possible deficiencies are identified;

e) help and encourage the adequate and reliable dissemination of mandatory information;

f) manage the PRSAC at Banrisul. The responsibilities of the Board of Directors include ensuring that the Institution complies with the PRSAC and taking measures to ensure its effectiveness.

Banrisul has a the Social, Environmental and Climate Responsibility Committee (CRSAC, in Portuguese), an advisory body to the Board of Directors, whose duties and responsibilities are to:

a) make recommendations to the Board of Directors on the drafting and review of the Social, Environmental and Climate Responsibility Policy;

b) evaluate if the actions implemented are in compliance with the Social, Environmental and Climate Responsibility Policy and, whenever necessary, make recommendations for improvement;

c) keep records of its deliberations and decisions;

d) evaluate and monitor the Bank’s sustainable performance and the effectiveness of the actions laid down in the Sustainability Plan;

e) monitor advancements in sustainability, seeking to identify opportunities and risks, in order to create value for the Bank and its stakeholders;

f) propose and follow-up the execution of initiatives that improve the Bank’s socio-environmental performance;

g) assisting the Board of Directors in incorporating sustainability into the Company’s business strategy and administrative practices and follow up its progress;

h) analyze, monitor and issue recommendations and opinions to support the Board of Directors’ decisions on policies and practices related to its field;

i) fulfil other duties determined by the Board of Directors.

The ratio of the annual total compensation for the organization’s highest-paid individual to the median annual total compensation for all employees is 12.0%, while the ratio of the percentage increase in the annual total compensation for the organization’s highest-paid individual to the median percentage increase in the annual total compensation for all employees is 0.8%.

Annual salary increases occur in April (regulatory promotions retroactive to January) and in September (collective bargaining agreement).

For calculation purposes, the CEO, who is not a Bank employee, was considered as the highest-paid individual. The other workers who are not employees were not considered in the calculation. The total compensation (salaries, bonuses, job commission, full performance bonus, annual bonus, overtime, singing bonus, relocation bonus, management, retirement bonus, and retirement incentive) was considered in calculating compensation.

The Chair of the Board of Directors is not the Company’s CEO.

In compliance with Law 13,303/16, every year, elected Management members attend specific training on corporate and capital market legislation, disclosure of information, internal controls, code of conduct, Law 12,846, of August 1, 2013 (Anti-Corruption Law) and other topics related to the activities of a publicly held company or government-controlled company. In 2022, ESG was included in the list of topics. Additionally, Management members may participate in other courses/events with themes pertinent to their responsibilities in the respective governance bodies, if said theme is interesting for the Company.

The Business Partnership and Open Banking Department has been working constantly with Bem Promotora on the Prevention of Money Laundering and Terrorist Financing (PLDFT, in Portuguese). In September 2022, Banrisul published its New Policy on Prevention of Money Laundering, Terrorist Financing and the Distribution of Weapons of Mass Destruction, which is a mandatory reading for all those operating the corresponding assets. This document was read by 1,440 operators.

Suspicions or evidence of non-compliance with Banrisul’s Code of Ethics and Conduct, policies, standards and institutional regulations in force should be reported through the Whistleblowing Channel, which allows the anonymous reporting of the misconduct, ensuring the right to confidentiality and protection against retaliation. The internal and external channels are available, respectively, on the Corporate Intranet and on Banrisul’s website (www.banrisul.com.br) and are intended for receiving misconduct reposts and complaints from employees and other stakeholders. The Control and Compliance Department is the independent area responsible for managing this channel.

Every six months the Board of Directors reviews a report on Banrisul’s Whistleblowing Channel. In compliance with article 3, paragraph 2, of CMN Resolution 4,859/2020, the Control and Compliance Department prepares a report with the following minimum information:

I – the number of reports received;

II – the nature of the reports;

III – the departments responsible for handling the situation;

IV – the average response time; and

V – the measures adopted by the Institution.

Strictly speaking, the Bank did not identify incidents of corruption in the form of offering or requesting of undue advantages. Banrisul did not terminate or refuse to renew contracts due to the involvement or possible involvement of a correspondent in corruption. Neither the Organization nor its employees are parties to corruption-related lawsuits.

Banrisul’s Board of Directors identifies and manages conflicts of interest based on, but not limited to, applicable legal standards provided for in Article 156 of the Brazilian Corporate Law and article 25 of its Bylaws. Furthermore, the Code of Ethics and Conduct is widely disseminated to management members, board members, employees, interns, members of the Banrisul Group, business partners, suppliers and service providers. In the event of a potential conflict of interest, members of the Board of Directors, the Audit Committee and the Ethics Committee must abstain from resolving on matters in which this conflict is identified. Another important document governing this topic is the Related-Party Transactions Policy that outlines the conditions credit transactions and other related-party transactions.

The item “SUBORDINATION, SERVICE OR CONTROL RELATIONSHIPS BETWEEN THE ISSUER’S MANAGEMENT AND ITS SUBSIDIARIES, AFFLIATES AND OTHERS” of the Company’s Reference Form informs the interest held by Banrisul management in management of other companies in the Banrisul Group. The only controlling shareholder is the State of Rio Grande do Sul.

Related-party transactions, as well as measures taken by Banrisul, can be found in Note 29, pages 118 and 119, to the 2022 Financial Statements, available here.

The Control and Risk Executive Office is responsible for managing the Institutions’ corporate risks.

As regards Integrated Capital and Corporate Risk Management, the Chief Risk Officer (CRO) is responsible for the Corporate Risk Management Department and his/her duties include ensuring that the risk process monitors, controls, evaluates and plans capital need and goals and identifies, measures, monitors, reports, controls and mitigates credit, market, IRRBB, liquidity, operational, social, environmental and climate risks associated with the Prudential Conglomerate, communicating said risks to the Risk Committee, the CEO, the Board of Directors and regulatory agencies.

The Corporate Risk Executive Superintendent reports to the CRO on the Institution’s risk management. At least every year, risk management reports are submitted to the Board of Directors for consideration.

Performance evaluation is an essential step to assess effectiveness, contributing to enhance the Organization’s governance. The Board of Directors carries out an annual formal evaluation of the Executive Board and its Chair performance, as well as of its own performance, a process that include self-evaluation questions. The annual evaluation is carried out according to procedures previously defined by the Board of Directors and is anonymous and individual.

All answers to the evaluation questionnaires are compiled into a report, which is sent to the Eligibility and Compensation Committee for prior analysis and then presented to the Board of Directors for consideration. The body itself suggests improvements in carrying out their duties.

Banrisul’s Whistleblowing Channel is a communication tool through which employees, customers, users, partners or suppliers report possible misconducts of any nature related to the Institution’s activities that affect its reputation and violate its internal controls and Banrisul’s Compliance Program. The whistleblowing channel is available on the Bank’s institutional website or on the intranet, where a registration form can be filled out anonymously.

The internal and external channels for submitting complaints and queries covered by the Policy are disclosed, respectively, on the Corporate Intranet and on Banrisul’s website – www.banrisul.com.br, in the section Whistleblowing Channel.

In the event of non-compliance with this Policy and related regulations, actions will be taken according to the level of the offender’s relationship with the Bank:

– if an Employee, sanctions provided for in item Sanctions of the Personnel Regulations will be adopted, appropriate to address the non-compliance;

– if an Officer or Board/Committee Member, the non-compliance will be reported by the Internal Audit to the Board of Directors, complying, when applicable, to Banrisul’s Whistleblowing Policy;

– if an Intern or Outsourced Employee, sanctions provided for in the agreement will be adopted.

If managers, other employees and/or other related parties become aware of misconducts and do not report them to the Personnel Department or the Whistleblowing Channel, they will also be held accountable.

Regardless of the degree of relationship with Banrisul and the penalty adopted, anyone who fails to comply with the organizational policies may be held civilly or criminally liable for proven misconduct.

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Jorge Luís Tonetto | Chairman - non-executive position | No | 2021 - 2023 |

| Claudio Coutinho Mendes | Vice chairman - executive position | No | 2021 - 2023 |

| Irany de Oliveira Sant’Anna Junior | Member - executive position | No | 2021 - 2023 |

| Márcio Gomes Pinto Garcia | Member - non-executive position | No | 2021 - 2023 |

| Eduardo Cunha da Costa | Director - non-executive position | No | 2021 - 2023 |

| Ramiro Silveira Severo | Member - non-executive position | Yes | 2021 - 2023 |

| João Verner Juenemann | Member - non-executive position | Yes | 2021 - 2023 |

| Rafael Andréas Weber | Member elected by minority common shareholders - non-executive position | Yes | 2021 - 2023 |

| Adriano Cives Seabra | Member elected by minority preferred shareholders non-executive position | Yes | 2021 - 2023 |

| Márcio Kaiser | Member - appointed by the employees - non-executive position | No | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Bruno Pinto de Freitas | Sitting member, elected by majority shareholders- non-executive position | No | 2021 - 2023 |

| Rogério Costa Rokembach | Sitting member, elected by majority shareholders- non-executive position | Yes | 2021 - 2023 |

| Gustav Penna Gorski | Sitting member, elected by minority common shareholders - non-executive position | Yes | 2021 - 2023 |

| Reginaldo Ferreira Alexandre | Sitting member, elected by preferred shareholders - non-executive position | Yes | 2021 - 2023 |

| Bruno Queiroz Jatene | Alternate, elected by majority shareholders - non-executive position | No | 2021 - 2023 |

| Tanha Maria Lauermann Schneider | Alternate, elected by majority shareholders - non-executive position | Yes | 2021 - 2023 |

| Vicente Jorge Soares Rodrigues | Alternate, elected by majority shareholders - non-executive position | Yes | 2021 - 2023 |

| Paulo Roberto Franceschi | Alternate, elected by preferred shareholders - non-executive position | Yes | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| João Verner Juenemann | Coordinator - non-executive position | Yes | 2020 - 2022 |

| Carlos Biedermann | Member - non-executive position | Yes | 2021 - 2023 |

| Eraldo Soares Peçanha | Member - non-executive position | Yes | 2021 - 2023 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Arnaldo Bonoldi Dutra | Member - non-executive position | Yes | 2021 - 2024 |

| José Luiz Castro Mendel | Member - non-executive position | Yes | 2021 - 2024 |

| Giusepe Lo Russo | Member - non-executive position | No | 2021 - 2024 |

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| João Zani | Coordinator - non-executive position | Yes | 2022 - 2024 |

| José Luis Campani Lourenzi | Member - non-executive position | No | 2022 - 2024 |

| Carlos Eduardo Schonerwald da Silva | Member - non-executive position | Yes | 2022 - 2024 |

| Luanda Pereira Antunes | Member - non-executive position | Yes | 2021 - 2023 |

| Márcio Gomes Pinto Garcia | Member - non-executive position | Yes | 2021 - 2023 |

| Member | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Claíse Muller Rauber | Coordinator - Non-executive position | No | 2022 - 2023 |

| Wagner Lenhart | Member - non-executive position | No | 2022 - 2023 |

| Marivania Ghisleni Fontana | Member - non-executive position | No | 2022 - 2023 |

| Jorge Luís Tonetto | Member - non-executive position | No | 2022 - 2023 |

| Marilene de Oliveira Ramos Murias dos Santos | Member - non-executive position | Yes | 2023-2023¹ |

¹ Sworn in February 2023.

| Name | Executive or non-executive position | Independent | Term of Office |

|---|---|---|---|

| Claudio Coutinho Mendes | CEO - executive position | No | 2021 - 2023 |

| Irany de Oliveira Sant’Anna Junior | Deputy CEO and Risk and Controls Officer - executive position | No | 2021 - 2023 |

| Claíse Muller Rauber | Products, Segments and Digital Channels Officer - executive position | No | 2021 - 2023 |

| Fernando Postal | Distribution and Retail Officer - executive position | No | 2021 - 2023 |

| Jorge Fernando Krug Santos | IT and Innovation Officer - executive position | No | 2021 - 2023 |

| Marcus Vinícius Feijó Staffen | CFO and IRO - executive position | No | 2021 - 2023 |

| Osvaldo Lobo Pires | Credit Officer - executive position | No | 2021 - 2023 |

| Wagner Lenhart | Institutional Officer - executive position | No | 2021 - 2023 |

| Marivania Ghisleni Fontana | Administrative Officer - executive position | No | 2021 - 2023 |

The joint development of commitments, indicators, and targets proposed by the Bank’s departments has been showing the topic’s greater maturity within the institution and the leadership’s stance. The main guideline is the Bank’s strategic planning, established by the ESG pillar.

The methodology used to create the agenda enabled a greater engagement of the units and executive offices, which had to work together and expand their knowledge. his is an ongoing process, but it is already possible to see advancements in the governance front. In order to prepare the ESG Agenda, Banrisul assessed internal and external information to obtain an overview of the efforts required to position itself aligned to market expectations. The Company used data from interviews with senior management and online stakeholder survey to prepare its materiality matrix, and meetings and workshops with key departments to get their opinion on suggested actions, targets and indicators.

The effectiveness of this measures is yet unknown, as their results will be seen after the due implementation of the 2030 Agenda.

| Impact | Classification (positive or negative) | Event (potential or actual) | Time frame (short-term or long-term) | Systemic or one-time impact | Irreversibility (high, medium, low - only for negative impacts) | Production chain process or activity that causes impact | Resource / stakeholder group impacted |

|---|---|---|---|---|---|---|---|

| ESG Agenda is not prioritized by Senior Management | Negative | Actual | Short-term | One-time | Medium | Definition of the Company’s strategy. | Shareholders and Investors, Employees, Suppliers, Banrisul’s Operations. |

| Lack of ESG information to the market | Negative | Actual | Short-term | Systemic | High | Preparing external contents. | Shareholders and Investors, Banrisul’s Operations. |

| Conflict of Interests, leading to controversial management | Negative | Potential | Short-term | Systemic | Medium | Senior management processes and activities. | Shareholders and Investors, Banrisul’s Operations. |

The Fiscal Council, through any of its members, is responsible for overseeing Management’s acts and verifying compliance with legal and statutory duties, according to the Fiscal Council’s Internal Regulation.

Banrisul does not have a policy on tax risk management. Some of the tax risks are identified, managed and monitored focused on Operational Risk, e.g., compliance with the legislation and rules.

The Operational Risk department identifies risks, whose control compliance are assessed by the Controls and Compliance department. Moreover, the Company has a whistleblowing channel, with a general scope that can receive reports on taxes.

Banrisul does not have a policy on tax risk management. Some of the tax risks are identified, managed and monitored focused on Operational Risk, e.g., compliance with the legislation and rules. The Fiscal Council, through any of its members, is responsible for overseeing and assessing Management’s acts and verifying compliance with legal and statutory duties, according to the Fiscal Council’s Internal Regulation. The Operational Risk department identifies risks, whose control compliance are assessed by the Controls and Compliance department.

| Tons of CO2 equivalent p.a. | ||||

|---|---|---|---|---|

| Type of emissions | 2020 | 2021 | 2022 | △ 2022/2021 |

| Scope 1 (Direct emissions) | 639.7 | 958.9 | 728.3 | -24.0% |

| Scope 2 (indirect emissions) | 2,067.6 | 4,642.3 | 1,446.8 | -68.8% |

| Scope 3 (other indirect emissions) | 31.0 | 5,054.4 | 7,685.0 | 52.0% |

| Total emissions (Scope 1, 2 and 3) | 2,738.3 | 10,655.6 | 9,860.2 | -7.5% |

| Total Biogenic emissions of CO2 in Scope 3¹ | 13.8 | 900.3 | 1,463.4 | 62.6% |

| Other - HCFC 22 (R22) | 2,970.7 | 3,010.0 | 1,007.5 | -66.5% |

¹Considers scope 1 and 3 emissions

As for fugitive emissions, which are encompassed in Scope 1 emissions, Banrisul began a process to modernize its air conditioning equipment, in order to reduce fugitive gas emissions. In this sense, we believe it is already possible to see a slight reduction in fugitive emissions due to this program.

As for mobile combustion, Banrisul will change the fuel used by its proprietary and leased vehicle fleet to ethanol in 2023. The goal is to have the entire fleet using this fuel whenever available (given that not every gas station offers ethanol, especially when the vehicles are located in smaller cities), in order to reduce emissions from mobile combustion.

The reduction seen in emissions for reference year 2022 was due to a reduction in the reference conversion factor used by the GHG Protocol tool. In 2021, the average annual factor (tCO2/MWH) was 0.1264 and, in 2022, it was 0.0426, which explains the decrease in tCO2 equivalent emissions.

Measurement of Scope 3 emissions improved after one year. For the 2022 inventory, Banrisul included additional information in the Upstream Transport category, related to light ATM maintenance vehicles that were not included in the previous inventories. Similarly, cash and money deposit bag transportation increased significantly, in absolute number of liters of fuel used from 562,557 in 2021 to 986,962 in 2022, largely due to the gradual recovery of the economy after the pandemic.

There are no reduction targets defined, since the Bank intends to increase the number of categories included in the Scope 3, leading to an upturn in emissions.

Climate change management at Banrisul includes transition and physical Climate Change Risks, as defined by CMN 4,943/21:

Transition climate change risks: possibility of the Institution incurring in losses arising from events associated with the transition to a low carbon economy;

Examples of transition climate change risks include legal and regulatory changes; technological innovations; changes in products and services supply and demand; unfavorable perception from clients the financial market or society in general; events related to the transition to a low-carbon economy and that negatively impact the Institution;

Physical climate change risks: possibility of the Institution incurring in losses arising from events associated with short and medium-term frequent and severe weather events or long-term environmental changes that can be related to changes in climate patterns.

Climate risk events can lead to financial and reputational losses, as well as to process inefficiencies. Possibilities of losses associated with the other types of risks to which the Institution is exposed, especially operational and credit risks, can be identified.

In addition to monitoring the regulatory environment and customer perception, management includes consulting information on public lists and verifying the activities, products and services subject to social and environmental legislation. As for the operations, Social, Environmental and Climate Risks inherent to the activity’s economic industry are identified, based on the National Registry of Economic Activity (CNAE – Cadastro Nacional de Atividade Econômica) code). Climate risk management costs are not calculated individually, but are considered together with the resources allocated to the Institution’s risk management.

Banrisul’s organizational structure includes the Internal Audit department, reporting to the Board of Directors, whose scope of activities considers all duties of Banrisul and the other companies in the conglomerate, in compliance with CMN Resolution 4,879/2020.

Therefore, as of the publication of CMN Resolution 4,945, of September 15, 2021, an audit forecast was included in the Internal Audit planning for 2022. Works began in August 2022 and were completed in February 2023. For 2023, a social, an environmental and climate risk management audit is planned according to CMN Resolution 4,557, of February 23, 2017.

The internal audit department is responsible both for the past and for the future audit, as per:

– CMN Resolution 4,945, of September 15, 2021

– CMN Resolution 4,557, of September 23, 2017

Below, we list some Internal Audit findings that are currently being monitored. We must note that all the findings/reports issued by the Internal Audit are in compliance with the Policy on Management of Internal Audit Findings, approved by the Conglomerate’s Board of Directors:

– Actions to ensure PRSAC’s Effectiveness: drafting/preparation and validation of indicators relates to the Sustainability Agenda. Expectation to hire an external consulting firm to assist in this process. Timetable/deadlines will be established by the managing department.

– Dissemination of Complete and Updated Information: combined actions of the Sustainability Corporate Department and the Institution’s other departments, in addition to the creation of working groups for mapping sustainable products and sensitive sectors as regards social, environmental or climate aspects, as well as the forecast for hiring external consultants to assist in this project. Timetable/deadlines will be established by the managing department.

– Implementation of the PRSAC: initiatives to enable the implementation of social, environmental and climate responsibility principle and guidelines established in the PRSAC, as well as to ensure their compatibility and integration with the Institution’s other policies. Expectation to hire an external consulting firm to assist in this process. Timetable/deadlines will be established by the managing department.

For policies and commitments related to this material topic, the Board of Directors approved the Social, Environmental and Climate Risk Policy (PRASC in Portuguese), which was published in June 2022 and aims to set out the guidelines for the Bank’s and Banrisul Group subsidiaries’ social, environmental and climate responsibility activities, aligned to the nature of their activities and the complexity of their products and services. The PRSAC seeks to foster sustainability, balancing business opportunities with social, economic, environmental and climate responsibilities, contributing to the sustainable development of the regions where Banrisul operates.

The Institutional Policy on Social, Environmental and Climate Risk Management, updated in 2022 based on new regulatory framework, is targeted at outlining the management processes, seeking to mitigate these risks and, consequently, safeguard the assets and interests of its customers, shareholders, employees and other stakeholders.

To manage the topic and its related impacts, Banrisul manages social, environmental and climate risks by identifying, measuring, assessing, monitoring, reporting, controlling and mitigating other corporate risks in an integrated way, keeping risk exposure at a level the Institution is willing to take and ensuring adherence to its Institutional Policies.

The Institution controls and mitigate potential negative impacts through initiatives and strategies that aim to keep exposure to social, environmental and climate risks at adequate levels. Risk treatment options are described and formalized through initiatives that can have one or more procedures and mitigate one or more risks.

Banrisul adopts a series of actions to mitigate potential negative impacts, mainly regarding the exposure of its credit operations, when applicable, i.e.:

– Contractual clauses determining that the borrower must comply with the respective legislation and adopt periodic monitoring;

– Contractual clauses foreseeing the possibility of early maturity of the operations in case of irregularities of this nature;

– Checking if environmental licenses and certificates are valid;

– Requiring the Biosafety Quality Certificate (CQB, in Portuguese), issued by the National Biosafety Technical Commission (CTNBio, in Portuguese);

– Applying the Survey of Indications of Contamination in Urban Properties (LIC, in Portuguese) form;

– Applying the social, environmental and climate risk analysis questionnaire, for operations above R$10 million;

– Monitoring agribusiness credit operations through the Social and Environmental Compliance System.

As regards its activities, Banrisul mitigates its exposure to potential negative impacts by adopting, among others, the listed action:

– In relevant contracting and procurement processes, it identifies the contracting risk matrix and social and environmental requirements.

The Institution identifies and remedies actual negative Social, Environmental and Climate (SAC, in Portuguese) impacts by consulting information in public lists and checking the activities, products and services subject to social and environmental legislation. As for operations, Social, Environmental and Climate Risks inherent to the activity’s economic industry are identified, based on the National Registry of Economic Activity (CNAE – Cadastro Nacional de Atividade Econômica) code.

As for the credit portfolio as a whole, Banrisul is developing a climate stress test model aimed at measuring the impact of climate events on the overall capital index, demonstrating the financial impact and defining new strategies for significant events.

The characteristics of the Institution’s products, services, activities and processes as well as the activities of its counter parties, controlled companies, suppliers and relevant outsourced service providers are assessed for potential risks of violation of fundamental rights and guarantees or acts harmful to the common interest; environmental degradation, including the excessive use of natural resources; and changes in weather patterns.

For each operational risk event, the Operational Losses Database identifies, when applicable, the operational losses linked to the Social, Environmental and Climate Risk. This scope is highlighted in civil and labor lawsuits, administrative proceedings, fines and other events.

To manage the positive impacts, the “Contribution to the Green Economy” indicator is monitored on a monthly basis to measure how much of the corporate credit portfolio is made up of economic sectors with a certain level of environmental and/or social contribution. This indicator is monitored by following up the percentage variation. The higher the percentage, the higher the active balance in financing to industries with a positive social and/or environmental impact, representing a higher contribution from the Institution.

The efficiency tracking processes are evaluated periodically, including assessing the internal and external audits, the Controls and Compliance department’s follow ups, operational risk analysis cycles, among other procedures. The Institution’s exposure to climate risk is monitored on a monthly basis, through the follow-up of the active balance of the corporate credit portfolio, allocated to industries with highly and moderate risk impacts.

The Bank also actively participates in FEBRABAN’s Committees and Working Groups, where it debates current relevant guidelines for this topic, participates in public consultations, and shares best practices with other companies in the industry.

As for goals, targets and indicators to assess progress based on Banrisul ESG Agenda’s recommendations, themes and strategic pillars were defined, and the Company set indicators and targets for strengthening management of social, environmental and climate risks and reducing climate risk.

Even though the Bank has robust risk management, there are still many opportunities to make progress in managing social, environmental and climate risks, especially in defining sensitive sectors and drafting restrictive policies. The recommendations of the ESG Agenda are based on Banrisul’s ongoing or planned actions/projects and the most prominent/most adopted actions by the financial industry.

In order to prepare the ESG Agenda, Banrisul assessed internal and external information to obtain an overview of the efforts required to position itself aligned to market expectations. The Company used data from interviews with senior management and online stakeholder survey to prepare its materiality matrix, and meetings and workshops with key departments to get their opinion on suggested actions, targets and indicators.

Moreover, Banrisul joined the Carbon Disclosure Project (CDP in Portuguese) and the Brazilian GHG Protocol program to enhance its technical and institutional capacity in managing greenhouse gas emissions in order to take stock and report.

| Impact | Classification (positive or negative) | Event (potential or actual) | Time frame (Short-term or long-term) | Systemic or one-time impact | Irreversibility (high, medium, low - only for negative impacts) | Production chain process or activity that causes impact | Resource / stakeholder group impacted |

|---|---|---|---|---|---|---|---|

| Climate change impacts on the Bank’s operation and the sale of its products and services (risk for the agribusiness segment - delinquency) | Negative | Actual | Medium-term | One-time | Medium | Credit assignment for agribusiness. The high concentration of the credit portfolio in customers whose economic industry is more likely to suffer financial impacts from climate change increases the Bank's exposure to physical climate risk. | Shareholders and Investors, Employees, Customers, Suppliers, Banrisul’s Operations. |

| Violation of fundamental rights and guarantees or acts harmful to the common interest | Negative | Potential | Long-term | Systemic | Medium | Financing to customers listed as employers of forced or compulsory labor | Shareholders and Investors, Employees, Customers, Suppliers, Banrisul’s Operations. |

| Contribution to a green economy | Positive | Actual | Short-term | Systemic | - | Credit assignment based on an economic model that results in improved human welfare and social equality, while reducing environmental risks and ecological scarcity. | Shareholders andInvestors, Employees, Community, Customers, Suppliers, Environment, Banrisul’s Operations. |

| Events related to the transition to a low-carbon economy | Negative | Potential | Long-term | Systemic | Medium | The high concentration of the credit portfolio in customers whose economic activity is connected to high GHG emissions increases the Bank's exposure to transition climate risk. | Shareholders and Investors, Employees, Suppliers, Environment, Banrisul’s Operations. |

| Reduction of the exposure to loss ratio | Positive | Actual | Long-term | Systemic | - | Transition of the credit portfolio to less carbon-intensive industries | Shareholders andInvestors, Employees, Customers, Suppliers, Banrisul’s Operations. |

| Operational, financial and reputational impact from the response time to critical events (related to operational and credit risk) | Negative | Potential | Short-term | One-time | Medium | Comercial relationship with sensitive and carbon-intensive industries. | Shareholders and Investors, Employees, Customers, Suppliers, Banrisul’s Operations. |

| Waste generated by type and destination (t) | |||

|---|---|---|---|

| 2020 | 2021 | 2022 | |